Monetary Policy Uncertainty Indices

We are pleased to host several newspaper-based Monetary Policy Uncertainty Indices. All are accessible from this page by clicking on the links below.

The Baker-Bloom-Davis MPU Indices for the United States implement the approach developed in "Measuring Economic Policy Uncertainty" by Scott R. Baker, Nicholas Bloom and Steven J. Davis. These indices are monthly from January 1985 to the present.

The Husted-Rogers-Sun MPU Index for the United States implements the approach in "Monetary Policy Uncertainty" by Lucas Husted, John Rogers and Bo Sun. This index is monthly and runs from January 1985 to the present. You can find their data and research at their website.

The Arbatli et al. MPU Index for Japan implements the approach in "Policy Uncertainty in Japan" by Elif C. Arbatli, Steven J. Davis, Arata Ito, Naoko Miake and Ikuo Saito. This index is monthly and runs from January 1987 to the present.

The Syed, Syed, and Ahmad MPU Index for Pakistan utilize this approach to build two measures of monetary policy uncertainty in "Measuring Monetary Policy Index for Pakistan" by Syed, A. A. S., Syed, K. H. B., and Ahmad, K. This index is monthly and runs from 2010 or 2015 (depending on the measure) to the present.

Interested data users should click on the links above and consult the indicated research papers for detailed discussions of the MPU indices and their construction. However, some high-level observations about the similarities and differences among these indices may be helpful:

- All MPU indices accessible from this page are constructed as scaled frequency counts of newspaper articles that discuss monetary policy uncertainty. The precise criteria for "monetary policy uncertainty" varies by MPU index. "Scaling" serves to adjust for differences in the overall volume of articles across newspapers and time.

- The two BBD MPU indices use the same criteria to identify articles about monetary policy uncertainty. They differ only in the set of newspapers covered: one version draws on hundreds of U.S. newspapers covered by Access World News, and a second version draws on a balanced panel of 10 major national and regional U.S. newspapers. In constructing their MPU indices, Baker-Bloom-Davis scale the raw monthly MPU count by the count of all articles in the same newspapers and month.

- The HRS and BBD MPU indices for the United States differ with respect to scaling factors, newspaper coverage and term sets. HRS scale raw MPU counts by the count of articles mentioning the Fed in the same paper and month. Thus, if newspapers devote less (more) coverage to monetary policy over time, it will likely result in a downward (upward) drift in the BBD MPU indices but not in the HRS MPU Index. In addition, HRS restrict attention to the Wall Street Journal, New York Times and Washington post - elite newspapers that likely devote more coverage to esoteric monetary policy matters (quantitative easing, forward guidance, etc.) than the broader set of newspapers that BBD consider. Finally, HRS aim to quantify uncertainty about U.S. monetary policy. In contrast, BBD seek to quantify concerns monetary policy uncertainty in the United States, regardless of whether those concerns involve U.S. or foreign monetary policy.

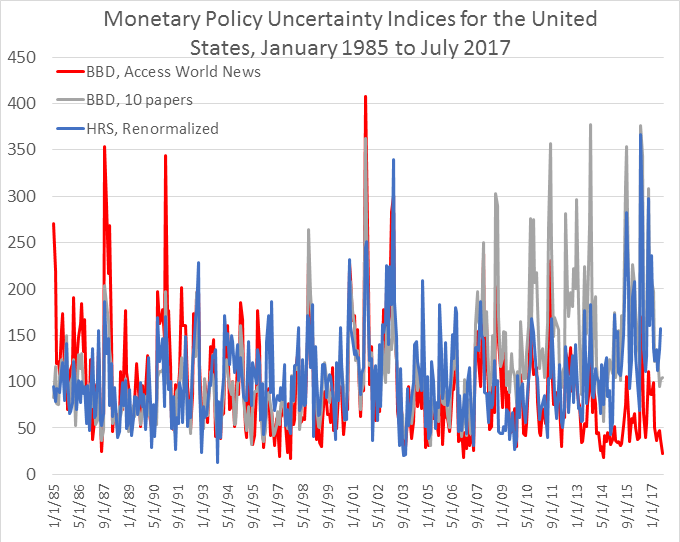

- The chart below plots the three newspaper-based MPU indices for the United States. (We renormalize the HRS index to a mean of 100 from 1985 to 2010 to match the normalization period of the BBD indices.) As expected, the HRS index correlates more closely with the 10-paper BBD index (0.62) than with the Access World News BBD index (0.49). The closer co-movement of the HRS index with the 10-paper BBD index reflects the greater similarity of their newspaper coverage. The two versions of the BBD MPU index correlate at 0.52.

- The Arbatli et al. MPU Index for Japan follows an approach similar to the one used in the BBD MPU indices. Of course, Arbatli et al. rely on Japanese newspapers and use appropriate Japanese-language criteria to identify MPU articles.